how much money do character designers make

Great design can be thanked for bettering lives–from beautiful buildings that help people coexist in big cities, to environmental solutions that clean air and water, down to everyday objects like an ergonomic task chair or just a really good pen. In other words, it solves big problems, and if there's ever a sector that's hungry for a redesign, it's financial services.

According to a recent survey, 49% of Americans aren't saving enough for retirement. Data from the Employee Benefit Research Institute indicates that 56% of all workers have less than $25,000 in the bank. An article in Barron's reports that young people are reluctant to buy cars, purchase homes, or start families while saddled with mammoth student loan debt.

How did we get to this sad place? Financial illiteracy, behavioral biases, poorly designed products, and misaligned interests are all to blame for America's woes, made all the more prominent by a global recession. But I believe the onus is on entrepreneurs to design and build products that align company and customer interests, anticipate irrational behavior, and incorporate guardrails against potentially damaging financial decisions.

The behavioral economist Richard Thaler says fear and anxiety are reasons why people aren't doing enough with their money. Paralyzed by uncertainty, they do nothing, which is disastrous for their long-term goals. Simply being too busy or overwhelmed by an abundance of options are other contributing factors to investing inertia, behavioral experts believe.

At Betterment, we're obsessed with understanding the effect of human behavior on financial decisions. It's why we have behavioral safeguards built into our product as a way to help people stay on track. To counteract behavioral biases–such as inertia, irrational decisions, or market timing–we follow these principles:

Elegance Lends A Sense Of Control

David Pogue once wrote, "In this increasingly technified world, there is still a surprising amount of red tape–and few examples of push back. We stress about things like price, storage and processor speed, instead of beauty, elegance and low friction."

Beauty, elegance, and low friction–these words are seldom used alongside financial products, and that's a problem. Countless studies have demonstrated that people have complicated emotional and psychological ties to money, yet financial products are notoriously impassive in their design.

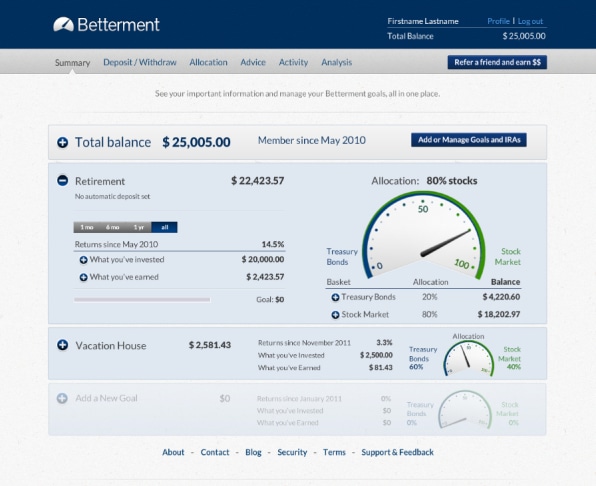

Elegant design assists with peace of mind. It abstracts out unnecessary complexities to help users quickly comprehend the state of their finances. This feeling of control is particularly important in times of economic uncertainty.

Cleanliness Keeps People From Freezing

The Princeton psychologist Eldar Shafir found that too many choices can make people feel overwhelmed, causing them to freeze in indecision, known as a paradox of choice. Financial products should make important and relevant information (like fees, balance, and returns) prominent and ensure that extraneous information (number of shares in each company, or share buys and sells) is readily available and transparent but not dominant. Intuitive user experiences help people make better decisions.

Good Behavior Should Be Automatic

As many studies show, saving has very little to do with willpower. Automating good behavior–like credit card or mortgage payments, bill payments, and savings contributions–creates a higher likelihood of success. Rather than making a decision to put aside $200 each month, it's much easier to just have that amount automatically deducted from your checking account.

Visualization Is As Important As Action

It's difficult for people to understand the repercussions of many of their financial decisions and budgets don't seem to help. According to Ideo, budgets have a major design flaw: Their emphasis on self-denial (no more lattés!) does nothing to motivate us, so we consistently fail. The answer is not to set arbitrary limits but to help people visualize the impact of their decisions, understand the tradeoffs, and make their goals tangible.

Betterment does this with real-time feedback, so customers understand the impact of different decisions–like allowing more time to reach the goal, contributing more funds per month, or setting a riskier allocation. Users can then use this information to adjust their accounts accordingly.

Americans' financial woes are not easily solved. We need input from every corner–perhaps government assistance, definitely more stringent regulation of financial products and brokers, and better education for consumers–but I'm convinced the onus is on the financial services industry to make the biggest change. There is a huge opportunity for entrepreneurs to tackle this issue the way we know best, through innovation, creativity, and hard work. Don't be shy–this industry needs your best designs.

how much money do character designers make

Source: https://www.fastcompany.com/1670153/how-good-design-can-guide-people-to-smarter-money-decisions